Transition plans that work for CFOs and asset owners

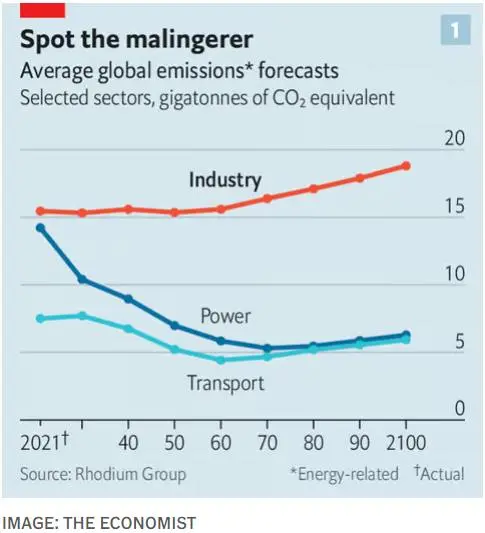

Transition finance is on the move and that’s great news. I recently posted on LinkedIn an article from The Economist titled First electric cars. Next, electric factories? highlights the challenges and opportunities especially for the industrial sectors. If we take a CFO perspective, these challenges and opportunities will come down to the question of when and how funding of specific decarbonisation strategies occur. These decisions today are key for future-proofing the CFOs’ businesses and their competitive advantage.

How to make funding work?

There are two crucial issues that go hand-in-hand with each other. First, it is vital to explain clearly to asset owners exactly how their strategy is contributing to solving the challenge of climate change. Second, since the climate issue is increasingly a material factor in business, CFOs need to further explain to asset owners and other stakeholders how the strategy will improve the company’s resilience and profitability while reducing business risks.

Reconciling the objectives

| Asset owners | CFOs |

|---|---|

| 1) Earn at least sustainable market returns, commensurate with the risk profile 2) Decarbonise the real economy, not just the portfolio | 1) Reduce the cost of capital 2) Reduce business risk 3) Increase the number of investors Specific to the transition plan: 1) Make sure the company’s business model and decarbonisation opportunities are well understood 2) Evidence that all decarbonisation levers are pulled, given the constraints |

The objectives of asset owners and CFOs can certainly be reconciled, and transition plans can be an effective tool both for companies to clearly communicate their strategy whilst giving investors a deep understanding of the goals and issues.

Transition Plans – A communication tool for engagement

I suggest three ways to make transition plans better and effective engagement tools for companies:

1) Use sustainable finance instruments where possible

There is an array of sustainable finance instruments that can support a credible plan, from labelled bonds and loans to sustainable supply chain financing. This is an important area of development as we all need to have better Key Performance Indicators (‘KPIs’) as a standard.

By directly connecting the plan to investments, and raising capital from investors, the plan becomes a more effective engagement tool, since:

a) Such instruments can explain how the plan is being funded

b) Some of these instruments, such as labelled bonds, give investors an opportunity to action the plan by investing in the instrument (on top of the stock)

c) The issuance of a labelled bond, if credibly structured, will give access to dedicated climate investors, and build up further engagement.

2) Consider credible transition labels for the plan

It is important to get credible third-party validation for the plan. The transition label space is in rapid evolution. Some of these labels are unsolicited. CFOs need to be aware of all the unsolicited labels currently available. For the labels that must be applied for, I would highlight the Net Zero Assessment Service from Moody’s and the transition plan certification by Climate Bonds Initiative. For example, EDF recently got its net-zero strategy assessed by Moody’s. See link here.

Other labels and actions could improve the overall picture too. For example, the Science Based Targets Network (SBTN), targeting validation framework, is an excellent option to tackle nature risks and opportunities in a way that is recognised by investors.

3) Collaboration between CFOs and CSOs and finance team leadership

As previously noted, a credible plan means establishing credible KPIs and action plans for a real roadmap beyond the reporting exercise, two of the main ingredients for this are: the leadership of the finance team and the cooperation between finance and the sustainability team.

A credible plan will need to be funded and sponsored. From a capital market perspective, the CFO has a major role as the face of the transition plan, especially when sustainable finance market instruments are used. Simultaneously, it will be the CSO who will be working to define the roadmap on the ground. The relationship between these two roles is crucial for a credible transition plan.

Although I can’t say a perfect transition plan exists, I am often asked for examples of good plans. The National Grid’s published transition plan is often mentioned as one of the best-in-class.

What about the risks?

Finance teams often mention to me the risk of being accused of greenwashing. There are two key points here to mitigate this:

1) Using transparent rationale and plans that are aligned to international standards. Also, actively engaging with the organisation setting those standards.

2) The strong conviction and leadership of both CSOs and CFOs (and their role in guiding the corporate strategy). Ultimately, climate transition (and other issues) is about change from the status quo to a more sustainable business that should lead to a reduction of business risks and an improvement in strategic advantage. Whilst the CSO will be operating on the ground, the CFO needs to buy it and finance it. In this instance for change to happen a tight collaboration and leadership is required on both sides. This is a topic that David Benattar (CSO at The Warehouse Group and senior advisor at Impactivise) will be exploring in more detail later this year.

We discussed in this blog how a corporate transition plan can work for both corporate CFOs and Asset Owners. It is fair to say that the onus is initially on the corporates. However, asset owners themselves need to have a transition plan. As such they face similar challenges, but they have different levers to execute them. Some of the levers were discussed here.

In the end, transition plans can work for both corporate CFOs and asset owners. We at Impactivise are committed to make that relationship as smooth as possible to make sure that the transition is being financed.

I look forward to your feedback!

Fabrizio