Hard-to-abate sectors and Asset Owners

Since an early age, I recall loving community gatherings, especially with my extended family, and sharing simple moments, such as dancing with my cousins to the songs of “Ricchi e Poveri” and “Abba”. Finding this sense of community professionally has been a long journey, which led to founding Impactivise in 2021. This enabled me to work across the entire financial community spectrum, from corporates to banks, asset managers, asset owners, climate NGOs, foundations and the University of Cambridge. However, after years of engagement, I found that when it comes to climate, Asset Owners lead the flow of capital, especially for hard-to-abate sectors, such as steel and cement.

Sectors, Pathways, Investing and Transition

The first part of understanding how to analyse and invest in hard-to-abate sectors in the context of a climate framework can be drawn from “Financing credible transitions” publication by Anna Creed, Manuel Adamini, Prashant Vaze and Bridget Boulle, at Climate Bonds. The report highlights five categories of activities for a 1.5C decarbonisation pathway. I have provided below a simplified breakdown of this, noting some hard-to-abate sectors appear under ‘On Pathway’ group.

| 5 categories of activities | Examples |

|---|---|

| Near zero ○ already at or near net-zero emissions ○ may require more decarbonisation but not a significant transition | ● wind power generation |

| On Pathway to zero ○ activities needed beyond 2050 target ○ have a clear 1.5C pathway | ● shipping ● steel ● cement ● packaging ● crop production |

| No Pathway to zero ○ activities needed beyond 2050 target ○ no clear 1.5C pathway | ● passenger aviation (long-haul) |

| Interim ○ activities currently needed ○ to be phased out by 2050 | ● municipal waste energy production |

| Stranded ○ not needed nor achieve 2050 targets ○ have no alternative | ● electricity generated from coal |

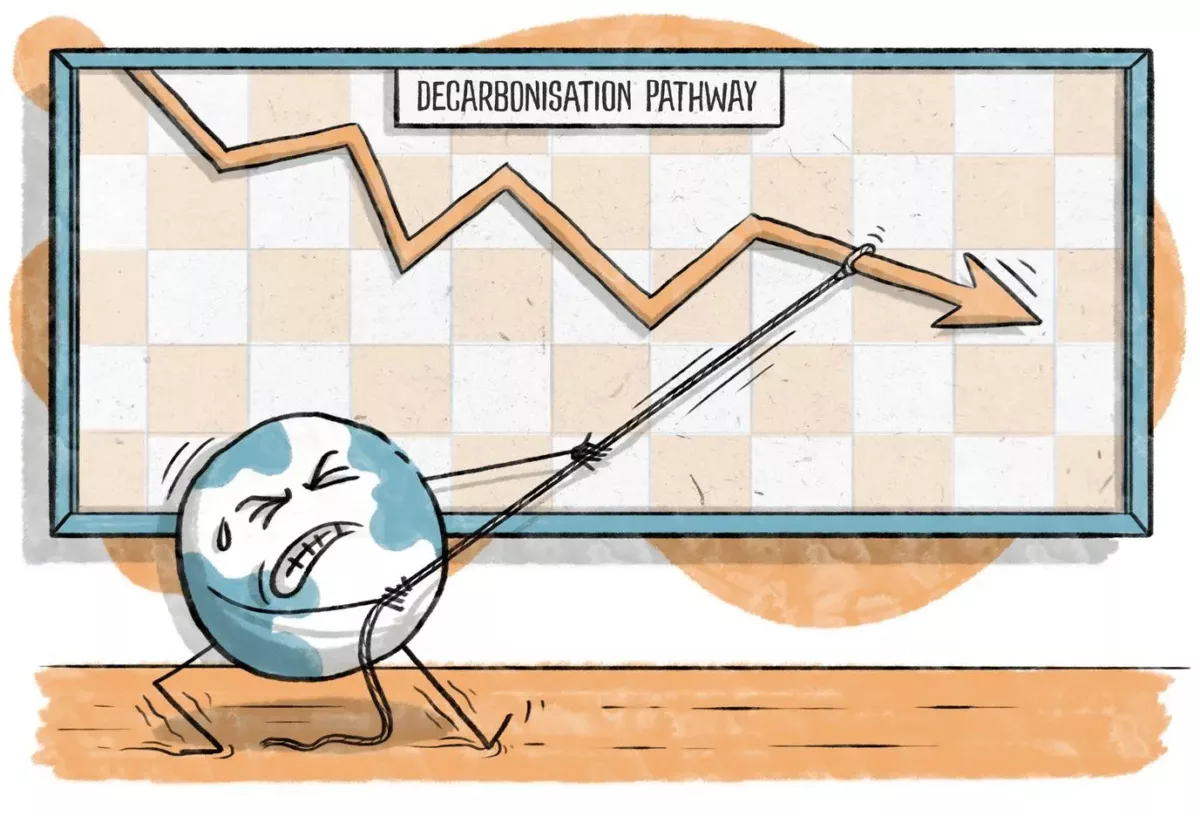

Hard-to-abate sectors including steel and cement fall under the ‘On Pathway’ category, which encompasses those industrial activities that will be needed beyond 2050. The same applies for chemicals, although presently there is limited pathway availability for that sector. When considering hard-to-abate sectors, some available pathways include: SBTi, IEA, TPI, Climate Bonds Initiative and One-earth climate model among others. Additionally, qualifying activities under a 1.5C pathway are available on Climate Bonds Initiative website, with detailed information on pathway, measures and assets. As a starting point, the outlined pathway categories are very helpful for any asset owner considering the climate transition of their portfolios.

Classifying investments is then the next step, that is the extensive work of defining the categories and sectors under which companies and investments will align. Ideally, investors need to have visibility on the company’s targets, any reported UoP, associated transition plans, and then compare these to available Paris-aligned pathways, thus producing a list of qualifying activities or sectors. Although, this type of effort is more the exception than the norm, as transition plans themselves constitute a whole different topic. Following, I will outline the challenges and opportunities on how to integrate these hard-to-abate sectors into a coherent climate-aligned investment portfolio strategy.

Challenges

After years of engagement with companies and investors, it is evident to me that we are not short of challenges for both the steel and cement industries, in particular for investors:

- High carbon footprint. Hard-to-abate sectors have a considerably high carbon footprint (scope 1 and 2). For example, I have seen in some portfolios that the top 10% emitters (inc. cement, steel, utilities and chemicals) can represent 70% of the scope 1 and 2 footprint of the overall portfolio.

- Unclear link: high carbon vs climate. It is challenging to clarify to clients and stakeholders how a portfolio’s significant carbon footprint fits into the context of a climate-aligned or decarbonisation goal, which is expected to follow a linear pathway.

- Lack of projects. Insufficient investable and bankable projects, because limited projects and assets are being developed in line with a 1.5C pathway.

- Uncertainty beyond 2030. In most of these industries, decarbonising along a credible 1.5C pathway by 2030 is both technologically and economically feasible, but longer-term decarbonisation has more uncertainty and is often dependent on new technologies and regulation.

- Regional differences. Although global sectoral pathways are available, there is a lack of detail on regional idiosyncrasies. For example, the EM context or the lack of feedstock availability, eg green hydrogen. This is a serious challenge for investors primarily focused on EM.

- Activities to entities. Taxonomies provide activity-based climate criteria but how to translate that into an assessment of a whole entity is a challenge.

Opportunities

In light of the global shift towards cleaner processes, technologies and products, these challenges offer a series of opportunities:

- Transparency and Engagement. Most Management of companies in those sectors understand that they need to be transparent and open to communication on their climate commitments and plans. This offers opportunities for dialogue especially for those investors that can leverage their asset base.

- New technologies. Sector challenges open the door to technological development opportunities.

- Thematic bonds. The burgeoning thematic bond universe, encompassing green bonds, SLBs, Social and Sustainability, etc, presents an opportunity to expand the investable universe, make companies more transparent about their plans and pursue engagement.

- Government support. The decarbonisation challenge will require significant subsidies to make some of the activities bankable and economical. Subsidies will likely be a major driver of success for the hard-to-abate sectors, especially in the area of circular economy and carbon capture.

- High impact. The hard-to abate sectors decarbonisation curve is potentially very steep.

- Brown to green taxonomies. Some of the taxonomies, eg Singaporean proposal, Climate Bonds, are trying to tackle hard-to-abate sectors by providing guidance, both on the threshold and on the measures that qualify as climate-aligned.

My recommendations

It is crucial for asset owners to continue investing in those sectors that will be part of a low-carbon world. Thus my recommendations to achieve this are as follows:

- Carving out hard-to-abate. For those investors with linear net-zero targets, consider carving out a portfolio dedicated to hard-to-abate sectors and consider external, third party verification for credible climate credentials.

- Projects and Use-of-Proceeds (UoP). Whenever possible, favour instruments with a Use-of-Proceeds (UoP) framework, such as Green bonds, SLBs, Social and Sustainability bonds or loans, and specific projects (project financing).

- Venture capital. Consider investing in venture capital projects such as technologies that are being developed to solve the decarbonisation challenges.

- Engage with development banks. The main development banks possess strong climate mandates and provide support to companies. Most of them are keen to crowding-in private capital for co-investments projects.

- 2030 decarbonisation target. Recognise that the 2030 target is achievable for most sectors, with time and technological development likely making further targets more achievable.

- Bespoke framework. Develop a coherent climate framework that tackles those sectors within the context of the current portfolio and other idiosyncratic positions, eg regional focus.

- Global standards. Align as much as possible to global science-based standards and frameworks.

In my next blog installment, I will delve into the pivotal role of green bonds in climate transition. I look forward to hearing your views.

Get in touch: fabrizio@impactivise.com

Publication links

Singaporean 3rd consultation paper on taxonomy

Publications from Climate Bonds Initiative:

Financing credible transitions framework

Steel sector criteria

Cement sector criteria