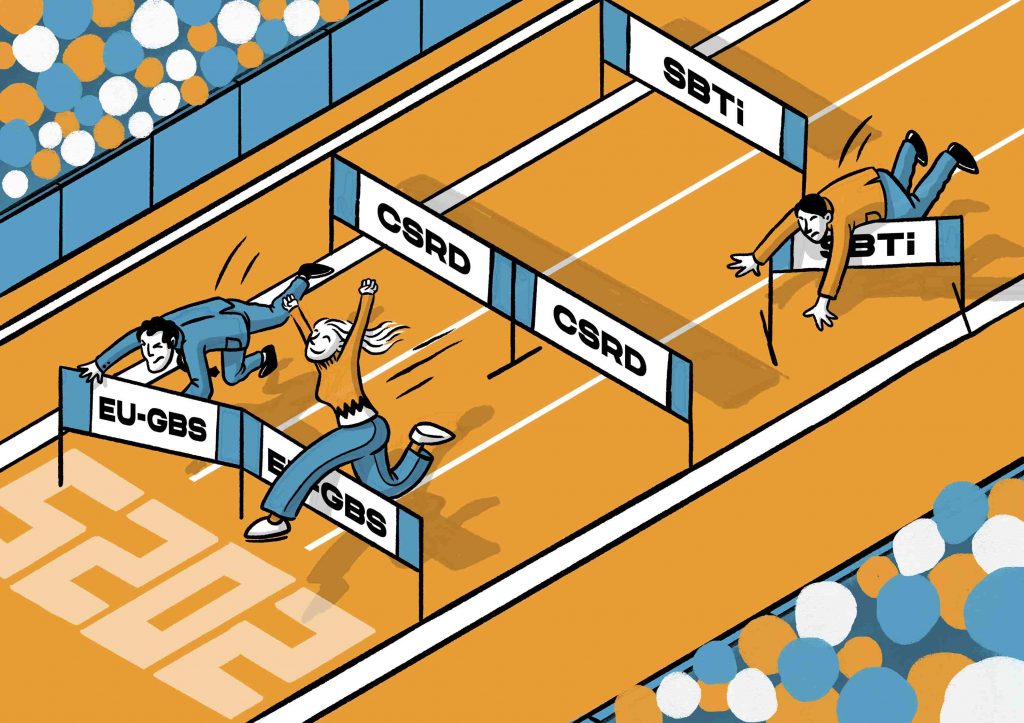

Climate finance 2025: Three key points Treasurers, CFOs and CSOs need to know

Climate finance in 2025 will be even more complex to navigate, primarily for two related reasons. The global the economy is not decarbonising at a 1.5C trajectory and some companies will find it harder to stick to those commitments. As such we will see a revision of company targets at a time when institutional investors need to operationalise their own commitments.

Therefore, both companies and investors will need to put in more effort to explain and analyze the distinctions between individual companies and their climate-alignment.

On the one end, it is an opportunity for companies to stand out. On the other hand, it will be more work for them to keep dedicated investors engaged and on board. In this short outlook for 2025, we will be exploring three themes that every treasurer and CFO keen to tap into climate finance should consider in the light of the above.

1) Publication of CSRD’s Transition Plans: which piece of info is helpful?

2025 will be the year of the first CSRD reports from the major European companies. One area of strong interest for investors is transition plans. These are meant to explain how companies and banks are expected to transition to a lower 1.5C economy. Here are three areas of focus:

Firstly, the time horizon. While plans will have to highlight short, medium and long-term time horizons, we all know that 2050 is way beyond the business cycle and therefore hard to quantify. However, stranded asset risk aside, how a company will reach its 2030 target (with the necessary Capex & funding) is the time horizon that matters. This is where, in my experience, most credible investors will focus on.

Secondly, to effectively leverage the huge amount of work required, it is important that the output is the result of collaboration across teams. While transition plans are often owned by Sustainability teams, collaboration with the Finance teams are a must to fully leverage the report in investors communications.

Thirdly, the sizeable amount of information and data will be a challenge to digest for investors. Best in class companies will understand what matters, what is most useful and as such will be able to efficiently synthetise.

2) Continued commitment from institutional investors- A balancing act for proofing portfolios

I expect institutional investors, asset owners, to further their climate commitments. In fact, according to my discussions they have just started to fully operationalise them, further pushing the asset managers to execute. One framework to look for is the one from the net-zero asset owner alliance, a coalition of leading asset owners, worth circa USD10 TN.

From the perspective of investors, operationalising those climate commitments is not easy though and the key will be to be sufficiently ambitious and credible while keeping the investable universe large enough as it seems that there are not enough 1.5C aligned investment opportunities. In the end though, their ultimate objective is to climate-proof their portfolios.

On the flip side this is a significant funding opportunity for corporates that are keen to transition and are demonstrating that they are doing all what they can to do so (despite some technological or policy headwinds for example).

Lastly, I expect private companies and private markets to be increasingly under pressure to show commitments and show their decarbonization strategies.

3) Assessments, Ratings and Labels. Which ones are worth it?

Given that companies and economies generically are advancing at increasingly different speed, typically not in line the 1.5C trajectory, it is important for corporate treasurers to monitor and select relevant labels judiciously. Both solicited (paid for) and unsolicited (they are assigned whatever) should be given attention to as many investors (both climate and non-climate) use them.

It is anticipated that some corporations will be losing their SBTi validation. Effectively communicating and managing the situation will be important for some of the finance professionals.

See previous blog here for more insights on labels.

A bird’s eye view for 2025 to understand what matters

The publication of CSRD’s transition plans, the continued commitment from sustainability and climate investors, and the evolution of labels, ESG ratings, and certifications will be key drivers of interaction between investors and companies in 2025.

Climate finance in 2025 will require treasurers and CFOs to really distinguish the noise from what really matters. They should align with their Sustainability teams and not lose sight of what is driving the real demand for climate aligned plans, strategies and assets: Long-term investors, asset owners, are keen to make sure that their investments, very long-term in nature, are proof from transition and physical climate risks.

I look forward to your feedback,

Fabrizio

Impactivise is a boutique advisory firm committed to facilitating the funding of the climate transition.

Since 2022, we have advised over 20 clients and facilitated more than $4 billion in investments.