Labels for financing the transition of hard-to-abate sectors

As discussed in our collaborative research report, The role of the Chief Financial Officer in driving the low-carbon transition, one of the goals of the CFO and his/her team is to keep the cost of capital in check whilst mitigating business risk. To achieve this and make investments flow, labels, certifications, or ratings are a key enabler. These tools are essential as they aid investors in navigating potential investments based on their desired credit quality and sustainability criteria.

However, the sustainability landscape is saturated with numerous labels, making it challenging for finance teams to discern their relevance. In this brief blog, we will explore some of the primary climate labels pertinent to finance teams operating in hard-to-abate sectors.

First, a word on ESG ratings

Much has been said on ESG ratings, especially in terms of their divergence. This causes frustration for many reasons:

- Upgrade/downgrade announcements can be unpredictable.

- The clarity and precision of the information underlying the ratings can sometimes be lacking.

- ESG ratings are formulated using diverse methodologies and processes, demanding substantial effort to stay abreast of.

Despite the above challenges, ESG ratings are important since they can drive index weights (especially on the equity side) and ultimately investor allocations. I would highlight here the MIT research from Florian Berg et al. on ESG ratings.

Transition Finance labels

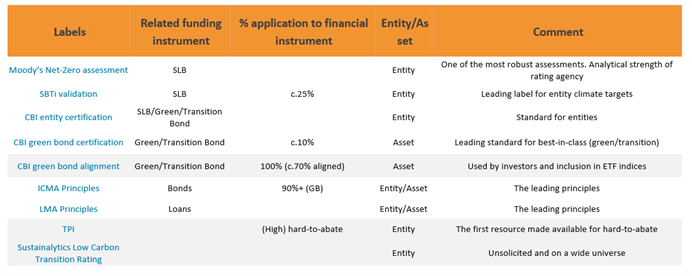

So which label is best? It all depends on what you’re trying to achieve and signal. It’s also important to note that certain labels are unsolicited, therefore it’s not always the choice of the finance team. However, in the context of the finance team, most of it ultimately relates to funding their organisation via a financing instrument.

In the table below, I have listed the capital market instruments that tend to relate to the different labels.

Key players in the world of labels

Principles

The main players in principles are the International Capital Market Association (ICMA) and the Loan Market Association (LMA). Both have been instrumental in the development of the thematic bond market, and the loan market. These principles are voluntary and generally require the finance team to engage with a third-party opinion provider that reviews the extent to which the sustainability framework is aligned to the principles.

GHG Target Validation

The Science Based Targets initiative (SBTi) is a major and important player in the validation of greenhouse gases reduction targets. Companies can get their climate targets validated by SBTi according to its Target Validation Protocol. The Science Based Targets initiative (SBTi) has emerged as a crucial player in transition finance, with approximately 847 companies in industries such as construction materials, building products, and chemicals either having their targets validated or committing to establish targets. Additionally, I anticipate that the Science Based Targets Network (SBTN), a not-for-profit focused on validating nature-related targets will gain momentum. By joining SBTN, companies are anticipated to pledge to nature targets—such as biodiversity, freshwater, land, and ocean targets—that are pertinent to their operations.

Certification

The Climate Bonds Initiative is a major player in providing robust, science-based certification for a range of debt instruments, assets and entities. Unlike the target validation model, Climate Bond’s Certification is based on the alignment of a project (e.g. in a green bond) or a transition plan to the Climate Bonds Initiative’s Standard and Sector Criteria. The alignment must be verified by a third party, approved verifier. To date, circa $300bn of green bonds have been certified under the Climate Bonds Standard and Certification Scheme.

Assessments

Released in 2023, Moody’s net-zero assessment service provides a solicited assessment of a company’s decarbonisation plan, based on a robust methodology. The assessment offers 5 different outcomes (from the highest score NZ1 to the lowest score of NZ5).

Unsolicited assessments

While many of the aforementioned labels are requested by companies, it’s crucial for finance teams in hard-to-abate sectors and beyond to also monitor two unsolicited labels or categorizations that can significantly influence investor interest.

The first is the transition assessment provided by the Transition Pathway Initiative (TPI), which evaluates a company’s transition plan based on publicly available information. The management quality score, ranging from 1 to 5, is transparent and readily accessible. As far as I’m aware, this is the inaugural analysis accessible to investors and dates back to 2017. I’d estimate that approximately 23% of global financial assets are managed, in some shape or form using data from TPI, highlighting its considerable importance.

The second pertains to green bonds. Regardless of how a green bond is issued, analysts from the Climate Bonds Initiative scrutinise each issuance to determine whether the use of proceeds is aligned with the Climate Bonds Initiative Taxonomy. Roughly 70% of the green bond market conforms to this alignment, while the remaining 30% do not.

Many asset managers subscribe to the Climate Bonds Initiative’s database, incorporating this screening into their analyses. Most green bond indices tracked by green bond ETFs exclude bonds that do not align with the CLimate Bonds Initiative taxonomy.

Final words

You may have noticed that I haven’t mentioned the EU Green Bond Standard. Although this standard holds significance as a regulatory framework and beyond, its exact impact on financing the transition sectors remains uncertain.

That being said, policies, markets and investors are on the move, and I’ll be keeping a close eye on the evolution of public policies and the sustainability-linked bond market to see how they’ll contribute to the decarbonisation efforts in hard-to-abate sectors.

Have I missed some other assessment? I look forward to your feedback!

Fabrizio