Mapping corporate climate assessments

In our previous blog, we explored various climate assessments and labels from both investor and issuer perspectives. These labels are essential tools for issuers to establish a Climate Credible Message, alongside other tools such as transition plans, funding plans, and strategic communication with investors among others.

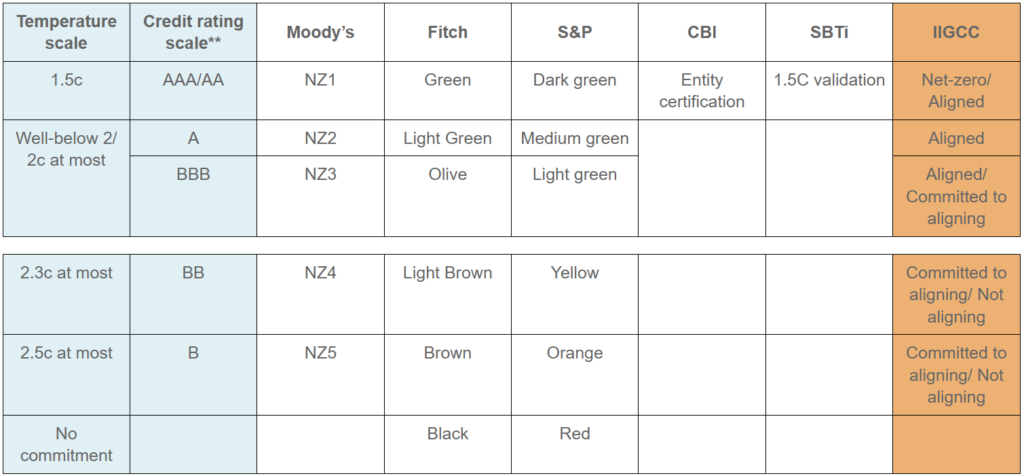

In this blog, we aim to map the climate assessments that issuers solicit and pay for. The outcome (see table below) of this exercise can’t be perfect because, although the assessments are well-constructed individually, the scales are not perfectly aligned. Nevertheless, our goal is to provide a comparison tool to both corporate issuers and investors (the ultimate users) and initiate a necessary process of scale convergence.

Mapping the scales, a first attempt

We have mapped the main pay-for assessments for entity-level labels using two scales: the temperature alignment (from 1.5°C to above 2.5°C) and the credit rating scales (from AAA to CCC). The logic is as follows:

The temperature scale

Starting from the Paris-agreement, science-based temperature alignment is said to be at 1.5c or well-below 2c alignment. Most investor frameworks recommend a science-based alignment (for example the IIGCC NZ framework). The 1.5c alignment is therefore a benchmark to build upon.

The credit rating scale

In the credit rating scale, there is a clear separation between Investment Grade (from AAA to BBB) and sub-investment grade (from BB to CCC). Science-based alignment (and we have included the below 2c alignment) will equate to Investment Grade while higher temperatures will be considered sub-investment grade.

I would like to caveat that this is not a simple exercise (although necessary if we want to scale transition finance). Some of the reasons incl.:

- Not all assessments refer to a temperature alignment. In those cases where no temperature alignment is provided, we have used our judgement and experience to assign a temperature.

- Not all assessments refer to the same time horizon (for ex. 2050).

- The scales provided are a simplification of a more complex process. In fact, besides the challenge to align to a temperature alignment, other factors incl. the implementation plan needs to be factored in. This consideration can influence the ultimate temperature ambition of an issuer.

Despite those caveats, we believe that the table offers a valuable first stab at a necessary alignment of scales. Why? We regularly get those questions in our work with both corporate finance teams and investors and the below mapping offers a good approximation.

Our proposed mapping for entity-level climate assessments*

*Our own interpretation based on public information from the different providers. See websites below

**The rating scale does not reflect the credit quality but is used as a guide to classify transition plans between science-based (Investment Grade) and others (sub-investment grade).

Choosing an assessment: the issuer’s perspective

As an issuer, the criteria for choosing an assessment versus another generally boils down to:

- Investor preference. The extent to which the assessment is recognized and credited by institutional investors.

- Credibility of the assessor and its analytical capabilities. Understanding from the analytical team of the sector in which the company operates. And therefore, accurate assessment.

- Connection to raising capital in capital markets. Ideally, the assessment can be linked to some type of capital market raise, including bonds and equity.

- Service & pricing. A credible and good dialogue between the assessor and the issuer is important, especially because many areas are qualitative in nature or in development. Every business has its own specificities.

I look forward to your feedback,

Fabrizio Palmucci

Founding Partner, Impactivise