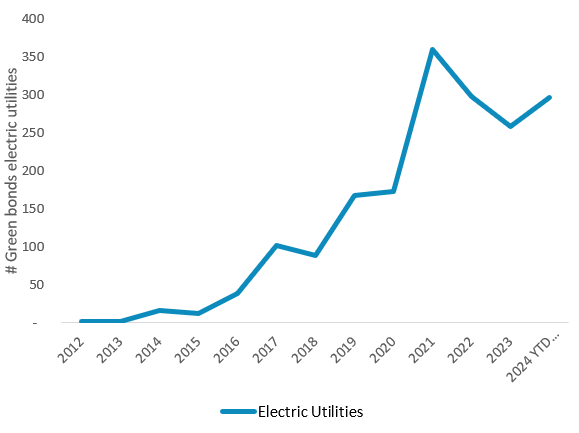

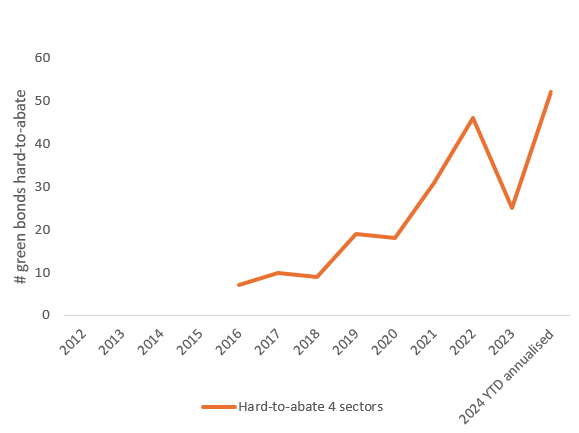

Green funding for hard-to-abate sectors. Like electric utilities 10 years ago?

# of green bond issued by electric utilities and hard-to-abate sectors globally

Source: Reuters. Hard-to-abate sectors: chemicals, pulp & paper, cement and steel

Electric utilities are today a major user of green finance markets to fund their operations and capex. If we take the green bond market as a guide, electric utilities are in fact the biggest corporate sector, after banks, with about USD 220bn1 worth of issued securities. Over the last 10 years, the sector has benefitted from several enablers to the definition of its decarbonisation path, namely:

- The development of renewable technologies and their subsidisation in the early stage of development.

- The increasing demand for Corporate Power Purchase Agreements (PPAs).

- The continuous fall of the cost for wind and solar technologies.

- The strong investor appetite for green investments and sustainable bonds.

Are we at the early stages of a similar development in chemicals, cement, pulp and paper and steel sectors? The challenge appears much bigger for those sectors compared to utilities 10 years ago. However, one can observe similarities in this early stage of decarbonisation.

Beyond regulation we see three themes: the emerging of new technologies in corporates’ CAPEX plans, their subsidisation and strong investor appetite for green investments in those sectors.

1) New technologies making their way in CAPEX plans

New decarbonisation technologies are making headway to the extent that some of these are now appearing in the list of projects that hard-to-abate companies are investing in to decarbonise their own operations. Such is the case, for example, of carbon capture, utilisation and storage or the use of hydrogen as a heating fuel. These are vital decarbonisation technologies for hard-to-abate sectors. Although these are not deployed at scale yet, projects are being developed at increasing pace. For example, according to Cembureau, the European cement association, “there has been considerable progress on CCUS development in the cement sector in recent years, with over 30 projects looking at the technology across Europe. Many projects are now foreseen to be operational before 2030, allowing to permanently store up to 12 million tonnes of CO2 yearly by then”2.

Given its transparency in terms of the use of funds, the green bond market is a good source of public information to attest of the emergence and investments of these new technologies. Here we look at three recent use-of-proceeds of three green bonds from three leading issuers in chemicals and cement sectors. The use-of-proceeds do include technologies like carbon capture or hydrogen.

Case studies: Green bonds in the cement & chemical sectors

| Heidelberg Materials | Cemex SAB DE CV | DOW | |

|---|---|---|---|

| Issue date | 19/06/2024 | 14/03/2023 | 09/02/2024 |

| Issue amount | EUR 700 mn | USD 1 BN | USD 1.2BN (2 bonds) |

| Project examples | • Modernisation and efficiency measures, e.g. replacement of inefficient technologies or general plant upgrades • Replacing fossil fuels, e.g. installations for the increased use of alternative fuels, especially biomass and infrastructure for alternative fuel usage. • Clinker replacement, e.g. installation of separate grinding, infrastructure for alternative raw materials, or calcined clay pilots. • Carbon Capture, Utilisation, and Storage • Air emissions reduction, water recycling, water treatment, and water quality, or biodiversity protection and restoration | • Construction or acquisition of facilities for the dosing of alternative fuels such as biomass fuels. • Use of hydrogen from electrolysis process in kilns to optimize the combustion process to further increase the use of alternative fuels. • Expenditures towards the substitution of clinker with other cementitious materials waste-derived additions such as slag and fly ash, pozzolans and calcined clays. • Investments, aimed at reduction of air emissions and greenhouse gas control, such as R&D and other capital expenditures for carbon capture, use and storage and carbon dioxide removal projects such as point source capture, carbon dioxide transportation, direct air capture, e-fuels, synthetic fuels, mineralization, addition of biochar to soils, bioenergy and carbon capture and storage (BECCS) | • Construction, development, and expansion of assets and infrastructure for Carbon Capture and Storage (CCS) connected to Dow sites. • Development, implementation and retrofitting of novel technologies for decarbonization (Scope 1 and 2 GHG emissions) of cracker facilities. (e.g., electrification, energy optimization and technologies that enable CCS). • Sourcing of bio-derived cracker feedstocks. • Sourcing of other bio-derived materials certified according to best-available sustainability certification. • Development, manufacturing and commercialization of waste- and bio-based products and solutions related to mechanical recycling, dissolution recycling, and advanced recycling. |

| Source: | Green bond framework & Reuters | Green bond framework & Reuters | Green bond framework & Reuters |

2) Subsidisation for a competitive return on investment

Renewables technologies benefitted from significant subsidies before becoming a profitable (see here background reading). For example, in the UK, subsidies included schemes like Feed-in Tariff or Contracts for Difference.

Moving from a phase subsidy to a market-based financing is complicated and non-linear. Several events and circumstances come into play be it technological development, public policies, geopolitical events, changing market demand for different types of products and new ways of operating (for example decentralised energy systems).

Although subsidies would need to be more large-scale for an effective system-wide decarbonisation (specific to Europe see Antwerp declaration with request to create a clean tech deployment fund) several schemes are already available to companies depending on their geographical location and business. These include for example, the well-known Inflation Reduction Act in the US but as well the EU Innovation fund in Europe or the contract-for difference scheme being put in place in Germany.

Some of the policy incentives for CCS projects

| US | IRA: $300 billion for projects that support clean energy deployment and infrastructure reinvestment (including CCS) and $25 billion for Carbon Dioxide Transportation |

| EU | Announced €3 billion in funding for climate technologies, including CCS projects, under the third call of the Innovation Fund. |

| UK | £20 billion to scale up CCS projects over a period of 20 years |

| Germany | Carbon Contracts for difference |

| Japan | JOGMEC supporting CCS projects |

3) Growing investor appetite: two reasons

Biggest impact for GHG reduction

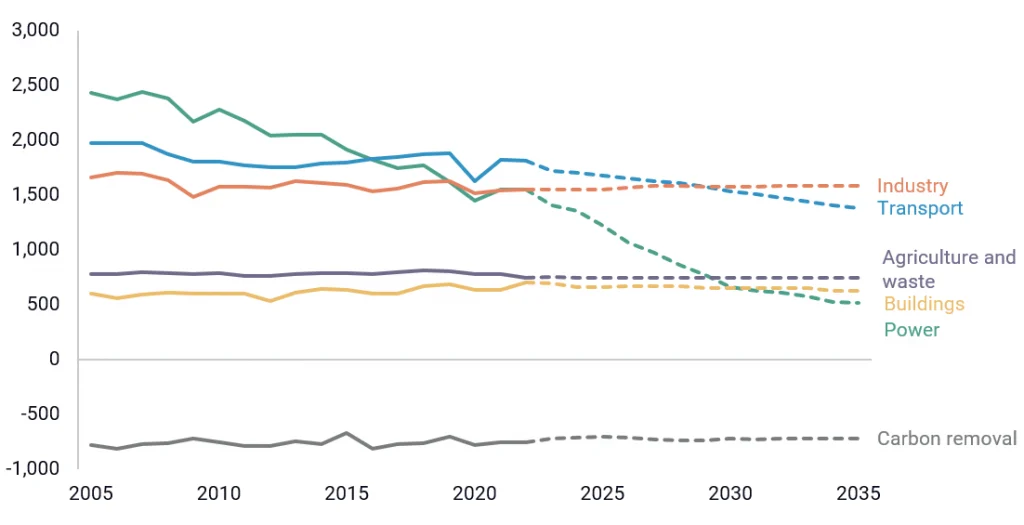

Firstly, positive impact minded investors are moving away from a vision of green investments that is confined to renewables. If we take the US as a case study, Rhodium Group, an independent research house, calculates that, by 2030, the industrial sector will be the largest emitter (direct emissions) ahead of transport and power as these are benefitting from the large-scale deployment of clean energy technology like solar and electric vehicles.

Investment diversification & returns

Investors need to be able to tap into a well-diversified investment universe with attractive risk-returns. If we take the green bond market as a guide, utilities dominate significantly with about 35% of market compared to 8% in the broad universe. This is a challenge for investors and at the same time an opportunity for issuers willing to tap into the green and sustainable bond and loan markets.

Green finance both a challenge and an opportunity

Leading companies and their treasurers in hard to abate sectors increasingly tapping into green finance is no coincidence. Like electric utilities 10 years ago, a confluence of factors is making this happen. It is both a challenge and an opportunity.

Putting in place green finance frameworks require a company-wide green strategy, so the first challenge is strategy, even before trying to look for funding. This is both a challenge and opportunity for treasurers and CFOs keen to influence their companies strategy and enhance their companies access to capital markets.

Sources:

1 – Reuters

2 – Cembureau: “From Ambition to Deployment. The road travelled, pathways and levers to scale up our net zero ambition.”