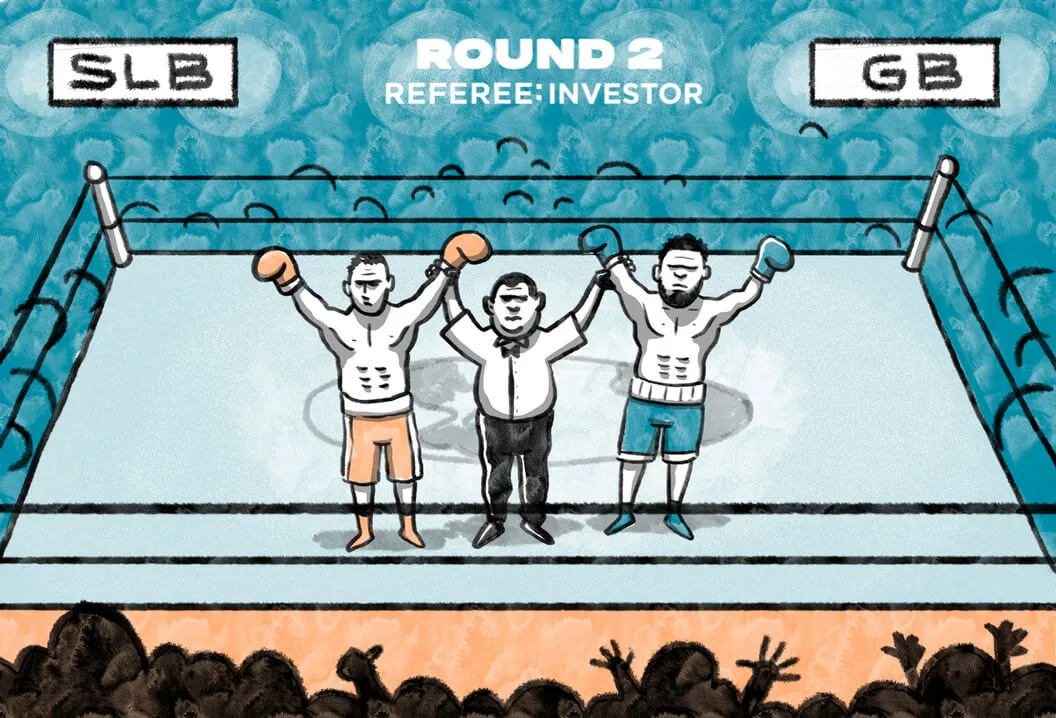

Green bonds vs SLBs: The bond investor perspective

Often, I am asked about my opinion on the outcome of Climate Week NYC or COP, and I have to say that this is a tricky one as everyone will have a different view depending on one’s interests (be it blended finance, VC, sovereign policy, etc). However, what caught my attention recently was the call for price differentiation between green and brown assets, a topic also raised by Philippe Zaouati, the CEO of Mirova on the back of comments made by Emmanuel Macron at COP last week.

In labelled bond land, where greenium is driven by investor demand, the comment made by the CFO of a large cap during a recent event I attended at Borsa (Italian stock-exchange) was quite telling about the current mood amongst investors:

“investors tell us not to issue SLBs but green bonds”

Taking all of these nuances into account, I will explore how bond investors are looking at both green bonds and SLBs.

Round Two: The bond investor perspective

On Round 1 of green bonds vs SLBs, we explored the CFO perspective and the pros and cons of when choosing to issue either instrument.

The basis for issuance of the labelled bonds is investor demand, in addition both sides of the investor market, institutional and retail, are naturally keen to invest in products aligned to sustainable outcomes.

For example, the latest Create Research survey highlights that 53% of the respondents, out of 158 global pension funds worth EUR 1.9 trillion in assets1, expect their active portfolio ESG allocation to rise 49% for passive portfolios, while 63% of respondents favour climate change as the main impact theme.

In addition, within climate as an impact theme, labelled bonds are instruments of choice and have grown significantly, although only representing 3% of global bonds. Therefore, some of the key considerations for investors is the expectation of impact. In that context, three main questions need to be answered:

- What does good look like?

- What are my labelled bond preferences?

- How do I demonstrate impact?

What does good look like?

Determining what is green or not green, or climate-aligned is not a trivial question and gave rise to the creation of the taxonomy which in simple terms is a list of what qualifies as a climate-aligned activity. There has been a flurry of taxonomies being created globally in the past, but a key concept here is that most of the credible taxonomies are science-based, that is because science-based approaches are helpful tools for investors to check on their green bond allocation alignment.

What good does look like for an SLB is slightly more complex to assess given that what needs to be confirmed involves the alignment of a KPI target to a science-based pathway, for material Scopes 1, 2 and 3, in a specific sector.

There are several tools in the market which investors can tap into to assess the credibility of these instruments, a leading one was developed by the Climate Bonds Initiative, the NGO, whose Market Intelligence teams run Interactive Data Platform databases, helping investors confirm alignment to their taxonomy (green bonds) and science-based pathways (SLBs), amongst other labelled bonds such as Social and Sustainability, Transition and Climate Aligned issuances.

Labelled bond preferences

In my experience this is a 50/50 split when it comes to the principles, this is because whereas some investors will value the project finance nature of a green bond, others will look for targeted activities, in line with a science-based taxonomy or the overall climate strategy of a firm, of which SLB KPIs can be a proxy. As explored on Round 1 of the previous blog, the CFO perspective, in this situation SLBs have the potential to be more effective.

Both labelled bonds have merits and limitations. What investors need is to fully understand characteristics for their structures, both in terms of impact vs credibility, and risk vs return. It is worth noting that in the last few months issuers have repeatedly shared with me that:

“investor appetite for green bonds has an advantage over SLBs”

This is especially true when a company can issue both instruments.

Demonstrating impact

Although green bonds are in essence a specific use-of-proceeds (UoP) type instrument, that is to say dedicated to a specific climate-aligned theme, it is difficult to consistently access impact reports of a whole portfolio. This is because not all green bonds benefit from the publication of an impact report, with only 60% to 70% of issuers making such information available. Furthermore, the metrics are inconsistent and hard to harmonise, despite the Green Bond Principles Impact Reporting Working Group having established voluntary guidelines in the past. Currently solutions are being worked out with proxies and AI.

SLB’s impact reporting is relatively simpler given that the metrics are consolidated at the entity level, as opposed to green bonds which report at project level. According to the ICMA’s principles, SLBs issuers are advised to report annually on emissions and KPIs against its targets. The key here is whether the target is ambitious or credible enough. It is interesting to note that the peak KPI trigger for the SLB market will happen in 2024, when 40% of the market will be tested against it.

My recommendations to bond investors

- Embrace all labelled bonds. Overall labelled bonds are an opportunity for both investors and issuers, the latter to demonstrate, implement commitment and enhance dialogue with fixed income investors, and the former to identify climate thematic opportunities with a combination of SLBs and green bonds.

- Do your analysis and differentiate. Accurate pre and post issuance due diligence of those structures is required as issuers can get away with weak climate targets or investments. For example, according to Climate Bonds Initiative about 25% of green bonds issued to date are not aligned to the taxonomy. That number increases to circa 70% for SLBs.

- Double check index rules of green bonds indices. Alignment with ICMA’s green bond principles is important but not enough.

- Go beyond (labelled) bonds. Labelled bonds are excellent starting points and important scalable solutions to channel capital to solve for climate risk and its crisis. However, they are not enough, some of the key drawbacks are that they do not necessarily fund projects that are inherently risky from a return perspective, a current challenge for the green hydrogen industry, nor the technologies still needed to be developed, which will be crucial to solve the climate crisis.

What about SLBs tied to CapEx targets? Are these the panacea? This is still unclear, a SLB tied to an entire company’s transition plan and related decarbonisation KPIs are in my opinion stronger instruments, as long as its targets are sufficiently ambitious, and although SLBs still need to mature as an instrument. I expect there will be more nuances of SLB structures in the future, adding to a more robust process embraced by bond investors as the gold standard.

I look forward to hearing your views on this and other topics.

Get in touch: fabrizio@impactivise.com

Sources

1 https://www.create-research-uk.com/content/info/reports/2023-ESGEvolution.pdf