From Italy: Why CFOs are interested in climate finance?

A busy week last week as I spent some time between Milan, Rome (and L’Aquila) to discuss transition finance with corporate CFOs and Heads of Finance. Of course, travelling to Italy means enjoying good food. My record this time was to eat artichokes at least once a day during my 3-day stay in Rome (alla giudia, alla romana, as a salad, etc.). I recommend them to anyone travelling to Rome.

Italian corporates are moving quickly to take advantage of the opportunities across an array of sectors, including hard-to-abate (cement, steel, oil & gas, etc.).

Let’s be clear though – from my discussions in Italy and beyond there is a growing sentiment that interest for ESG assets is slowing down and this is something that CFOs are considering.

I see this slowdown sentiment as cyclical because the structural forces at play still remain both from a finance and business perspective These forces are compelling companies to evolve their business models and this transcends any cyclicality in investors sentiment.

Those forces are long-term in nature. I still vividly remember former CFO of Enel, Alberto De Paoli, at Climate week in New York last September, showing on one slide the EBITDA margin of the company after the business transformation into renewables. From c. 15% in 2014 to c.20% in 2023. In the same period the market value increased by about 70%. It did take a few years to achieve despite all the events in between (2016 Oil crash, Trump being elected, COVID-19 pandemic).

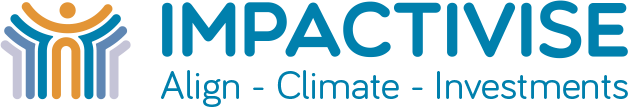

Climate-minded investors (see chart below on expected allocation) are accelerating that movement via their medium to long-term commitments and the main challenge currently is the lack of availability of climate-aligned projects to invest in.

From my recent conversations I have identified three key drivers that bring transition finance front and centre of the minds of CFOs and CSOs:

I) Access to capital

We all know Lou Gerstner, celebrated for his turnaround of IBM when he was CEO (1993 – 2002), who declared that culture was the game.

Here, from a CFO perspective, access to capital and its lower cost is the game. It is relatively straightforward to argue that climate/transition finance can help enlarge the pool of available capital to companies. Not only is there a pool of dedicated green investors but also even non-dedicated green investors would prefer, ceteris paribus, a green labelled alternative to plain-vanilla bonds or investments. Several drivers are at play, including:

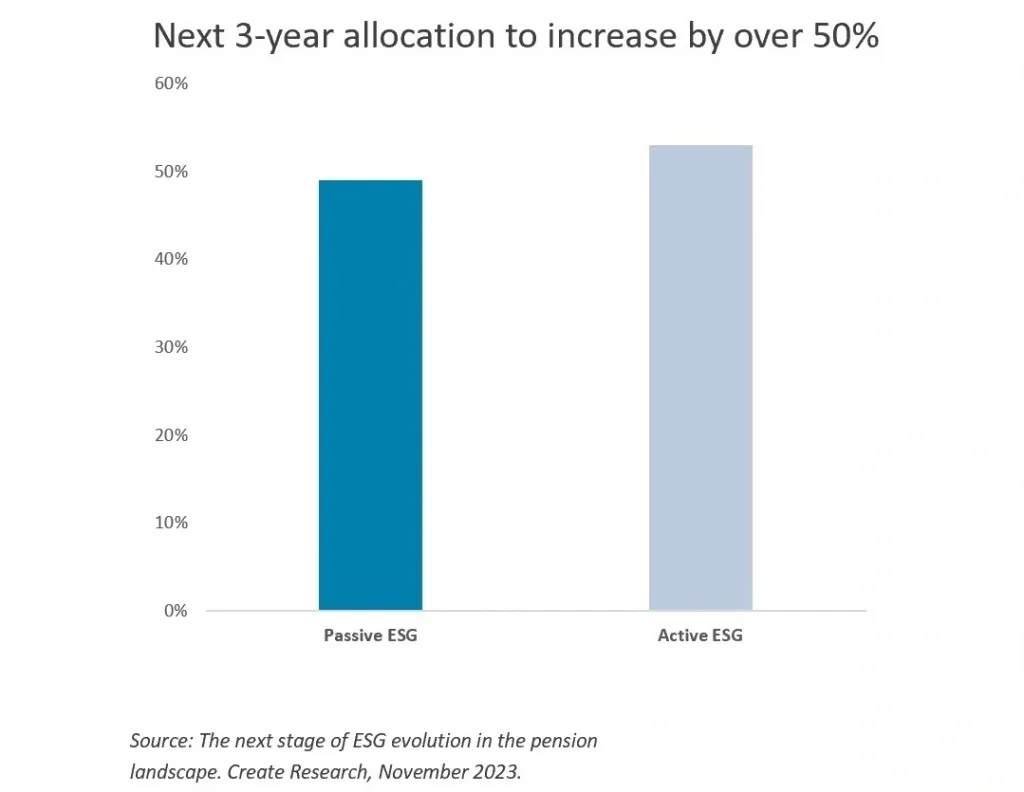

- Climate commitments from investors

- Lack of investable green assets

- Specific to green bonds, liquidity/better secondary market performance (for example, there is a strong buyer base for green bonds that makes it easier to sell it)

- Improvement of the sustainability metrics of a fund

Appetite for ESG

Banks

Global banks keep tightening their policies. Banks are tightening their lending criteria to meet their own targets. After Deutsche Bank did so in October last year, HSBC recently disclosed their transition plans. I recommend reading the HSBC report as it, among others, offers a candid view of the state of play in the different sectors. Barclays did publish its report some days ago as well.

From green to transition

The climate finance discussion is evolving too: from the green issue to the transition issue. Higher quality debate is now taking place for sectors perceived as ‘less green’ or ‘brown’ (as opposed to just considering these as not part of the solution and therefore not-investable from a climate perspective). A more mature discussion is happening as we are moving from net-zero commitments and declarations to real-world implementation. The best-in-class companies across sectors are great at demonstrating, credibly, how their corporate strategy is effectively and genuinely helping the economy to move towards a 1.5C trajectory.

II) Carbon pricing

Currently, CO2 pricing does not seem to be a significant cost for companies given the level of free allowances. Also, in my conversations, a price of EUR150 is often discussed, way above the current c. EUR 65 a tonne on the ETS market. In any case, any finance professional would need to consider scenarios where CO2 pricing is way higher than today’s levels. Finance executives in energy-intensive industries, including oil refineries, steel works, and producers of iron, aluminium, metals, cement, lime, glass, ceramics, pulp, and paper. are making the simple calculations that show how significantly lower free allowances will hit their cashflows. For those energy-intensive industries, often the $500 million question is whether carbon capture will be the solution and why, or why not, to invest today.

There is still lots of uncertainty whether the CO2 technology is viable economically. This makes finance executives sceptical and sometimes inclined to sit on the fence. Today, projects rely heavily on subsidies, and their economic viability will depend crucially on the future path of carbon pricing. All in all though, given that the lead time to a project can be up to 5 years, companies have to be on top of this issue. According to the International Association of Oil Producers, in Europe there are 46 CCS projects expected to capture about 110 MT of CO2 by 2030 This is still a tiny fraction of European emissions which stand at about 5 billion MT of CO2 per year.

III) Reporting regulation on transition plans

Reporting on transition plan is quickly becoming a reality for the blue-chip corporates. Best-in-class finance teams are working on these already. There are, however, many different frameworks that have been created by a variety of organisations, ranging from regulators (ESRS E1, TPT) to NGOs and standard-setters. For those interested, The Climate Bonds Initiative has recently published a very handy mapping of available transition frameworks. See here: Transition Finance Mapping.

This is really timely as the investor/issuer conversation is now clearly evolving from use-of-proceeds project based financing to the overall decarbonisation strategy of an entity.

CFOs and their finance teams are therefore busy, very busy, navigating through ways to support financially their company’s climate strategy while keeping abreast of evolving regulation and investors’ changing requirements.

As for me, the trip reminded me of the strong connection that needs to exist between finance and strategy. Climate finance is there to support credible climate strategy.

My final word. I ended my trip with a visit to L’Aquila, a good hour from Rome. The city was shaken by an earthquake in 2009 and it is now enjoying a strong recovery momentum with its reconstruction. In L’Aquila I met Silvia Scozzafava, founder of Aichi, https://www.aichio20.it/, a start-up that certifies carbon credit from biochar. Silvia gave me a lesson on what biochar is It made me excited and hopeful that there are many ways for companies and our economy to decarbonise.

I look forward to your feedback!

Fabrizio