Climate Investor Dialogue Part 1: The Corporate Perspective – Be CLEAR

How leading companies prepare for meaningful climate conversations with dedicated investors

Supporting companies in engaging with investors on their climate strategy is one of my favourite activities. Why? Because when it’s well executed, it unlocks substantial value for both sides.

For companies, these conversations are more than a reporting exercise—they are an opportunity. Done right, climate engagement with investors can build trust, secure long-term capital, and position the company as a leader in sustainability.

Today, climate-focused investors (often referred to as dedicated investors) are no longer a niche group. They are growing in influence and increasingly shape corporate sustainability agendas. According to a recent JP Morgan analysis[1] of the top 100 global asset owners, USD 17.9 trillion in assets integrate sustainability with active ownership practices, while USD 9.4 trillion have direct climate targets attached.

This means climate-focused investors represent not just an influence—but a significant source of funding.

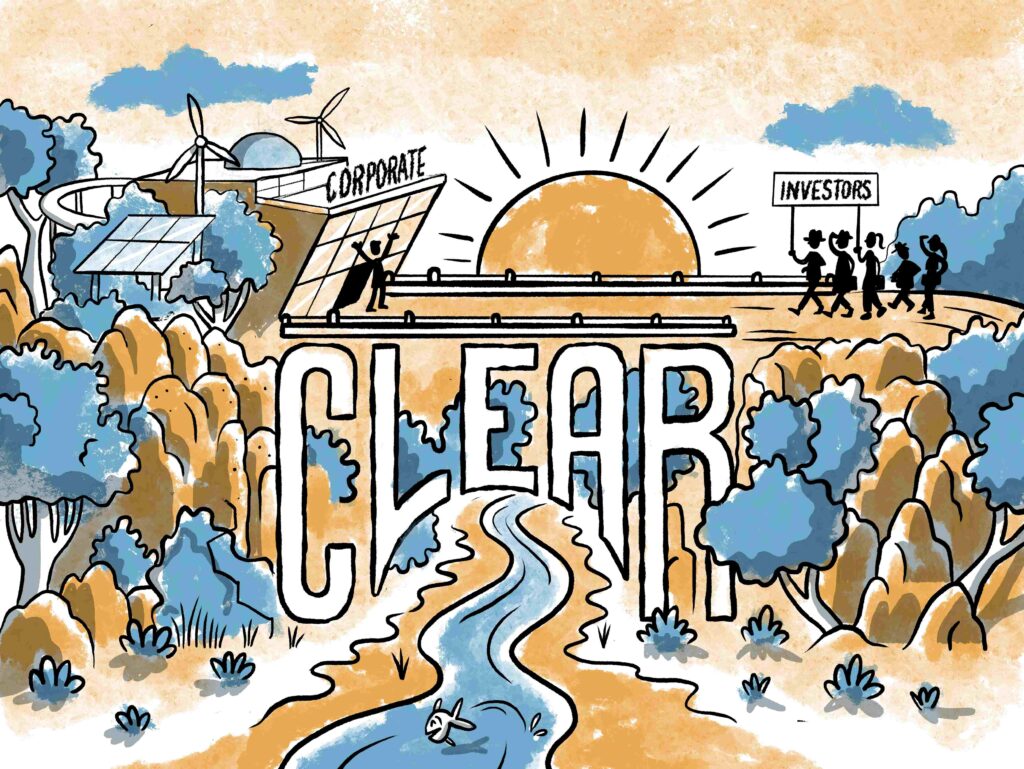

Yet making these investor–corporate conversations meaningful isn’t always easy. Alignment across the leadership team—typically the CEO, CFO, CSO, Head of Finance, and Investor Relations Officer—is critical. The story told must be compelling, credible, and consistent. Based on our experience, the CLEAR framework is a practical tool to guide these conversations.

The CLEAR Framework

C – Contextualise from Scratch

Assume zero investor familiarity with your company.

Start every meeting as though your audience knows little about your company, your business model, or your climate journey. Even if you’ve met before, a concise, up-to-date refresher helps reestablish common ground.

Remember: institutional investors—particularly those in public markets—meet with dozens of companies regularly. Even if they follow your sector, they may not retain company-specific details or be current on recent developments. Set the stage clearly and efficiently.

L – Leverage External Validation

Support your narrative with credible third-party references.

Integrating ESG benchmarks, peer comparisons, regulatory frameworks (e.g., EU Taxonomy), and market trends not only builds trust but demonstrates that your strategy aligns with broader expectations.

Whether through certifications, ratings, or alignment with globally recognized standards, curve or external validation helps substantiate your climate plan. Even if full validation isn’t practical in your sector, referencing key benchmark, target or standard for part of your strategy is important to gain credibility.

E – Emphasise Your Context

Highlight what sets your context and therefore strategy apart.

Each company faces its own operational realities, constraints, and opportunities. Be clear about what’s specific to your business and how that shapes your climate strategy.

For instance, a company in the waste management or cement sectors may need to rely on carbon capture to fully decarbonize—an essential, yet currently unbankable technology. Such specificity gives credibility and depth to your strategy.

A – Acknowledge Dependencies Openly

Demonstrate maturity by addressing external factors.

No climate transition happens in a vacuum. Be transparent about the interdependencies that may affect your plan—be they technological (e.g., emerging solutions like hydrogen or carbon capture), regulatory, or supply chain related.

Honest, well-articulated discussions of dependencies show that your team understands the full landscape and is managing risk responsibly. Importantly, this isn’t about using challenges as excuses—but recognizing where progress depends on broader system shifts.

Take cement, for example: many leaders in the sector are on track for a 1.5°C pathway until 2030, but reaching net zero beyond that point will likely depend on scalable, financeable carbon capture technologies.

R – Reinforce the Narrative Consistently

(Implicit in all the above) Repetition and alignment across leadership build trust. A consistent narrative ensures investors leave with clarity and confidence.

In short, preparing well for investor discussions on climate is a strategic investment in itself. The CLEAR framework can help ensure your message is not only heard—but trusted, understood, and acted upon.

I hope you find this blog helpful and I look forward to your feedback,

Fabrizio Palmucci

Founding Partner, Impactivise

Impactivise is a boutique advisory firm committed to facilitating the funding of the climate transition.

Since 2022, we have advised over 20 clients and facilitated more than $4 billion in investments.

Source: JPM: Sustainability – The Long View. Asset Owners’ Sustainable Investing Preferences: A $11.7trn Opportunity for European Asset Managers? June 2025