How can CFOs benefit from climate finance

Climate finance for CFOs

An increasing amount of finance is becoming available for climate-aligned companies and projects. Recently I discussed some of these topics during my keynote speech at the Italian stock exchange in Milan (Borsa). This is a specially curated event for CFOs of listed Italian companies. During the panel discussion with four CFOs of leading firms in Italy I observed the considerable interest in decarbonisation and climate topics from both companies and investors.

Keynotes such as this are interesting for different reasons as they can break the ice and help introduce new topics. As an independent advisor, it is an opportunity to bring forward ideas from my global engagements, one of these is the research focusing on the CFO role in the transition to net zero. This was carried out in collaboration with Climate Bonds Initiative and the CFO coalition of the UN Global Compact, covering interviews with 30 CFOs, and their teams, representing $1 trillion of market cap.

Access to the presentation deck is available to subscribers. Click here to freely subscribe and download the presentation.

CFO and climate projects

| Key responsibilities | Key considerations |

|---|---|

| 1. Key source for external updates | The CFO, together with Investor Relations, need to stay abreast of all external developments related to the financial responsibilities, reporting and risks which may affect the company’s strategy and capital expenditure on climate and transition projects. |

| 2. Steward of the business model | Is the business model resilient to climate transition risks (Clients, regulation & investors)? |

| 3. Capital allocation | Are climate projects appropriately assessed? Are assumptions underpinning allocation decisions fully taking into account climate transition risks? |

| 4. Fund raising | What is the CFO narrative to investors in relation to its climate strategy? |

| 5. Reporting coherence between financial and non-financial aspects | How does financial reporting reconcile with financial and non-financial strategies? |

Following, I summarise some of the key points of this presentation.

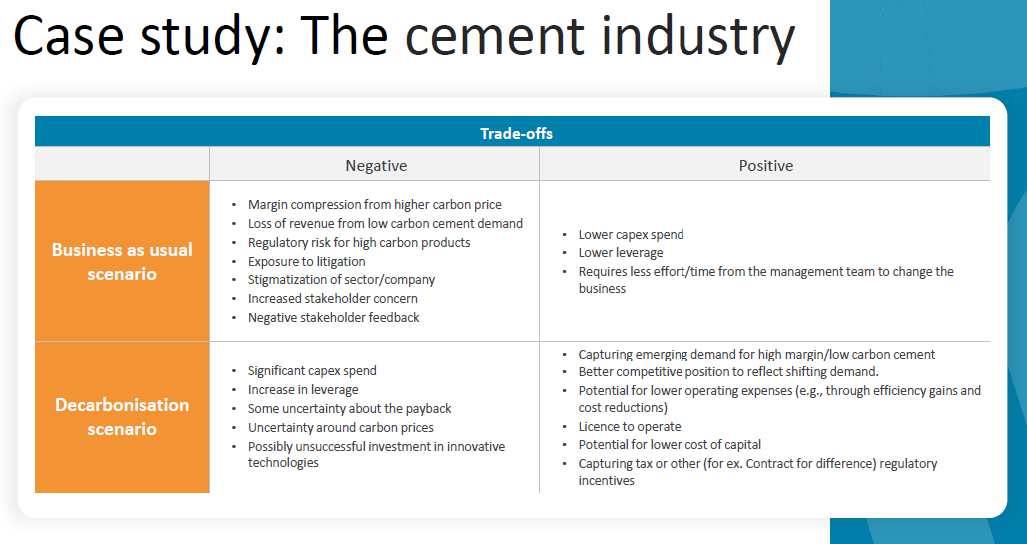

Not all industries are facing the same pressures. Hard-to-abate sectors for example are under more pressure compared to the service industry or pharmaceuticals. However, every industry is facing challenges one way or another. For instance, there is increasing investor pressure for companies to tackle upstream scope 3 emissions, especially for capital intensive businesses.

Following I list some of these challenges from a CFO perspective:

- Communication. How companies correctly communicate their green credentials is a constant challenge. A clear internal definition of green and sustainability efforts is needed for the purpose of communication. Guidance from green taxonomies is a starting point but expert input is still required for the transitioning sectors.

- Setting targets. It is challenging to set decarbonisation targets that are credible to investors and which employees believe to be achievable. CFOs need to be better prepared to mitigate certain levels of uncertainty, such as evolving technology for example. The CFO research revealed that about two-thirds, despite having a plan, could not guarantee they will hit their 2030 decarbonisation targets.

- Large CapEx. Meeting targets is a crucial issue for capital intensive sectors and especially those constrained by their credit rating. Capital expenditure (CapEx) for some of these projects can amount to $300 million for just one plant. The cement companies are a good example, because despite being committed to decarbonisation they may significantly rely on carbon capture and storage (CCS) technology, including the controversial direct air capture. Thus a CFO’s well planned CapEx target can be vital in developing off-balance sheet strategies that are credible to investors. This in addition to a combination of public policies, grants and incentives for the adoption and investments in those technologies.

Source: Impactivise

What are the different steps on the CFOs’ decarbonisation journey?

CFOs’ Decarbonisation Journey

| STEP 1 | Procure specialised input pre and post implementation of a transition plan | This allows for in-depth and unbiased feedback adding agility to the process. The topic is ever evolving as are competitors, capital markets, ratings and labels, including commercial and non-commercial labelling organisations such as NGOs. |

| STEP 2 | Consider the issuance of labelled instruments | Consider signalling the green intention with the labelled bond market, such as green or sustainability-linked bonds (SLBs) and loans. Additionally, these instruments help align internal stakeholders to a climate target. Alignment to ICMA principles for labelled bonds should be a starting point but not enough to gain full credibility from investors. Alignment with Paris-aligned taxonomies and frameworks is advisable to gain full credibility. |

| STEP 3 | Analyse the relevant universe of transition finance labels | CFOs are generally aware of the significance of ESG ratings in determining whether investors can invest in their company’s products, or if their company is part of the investable universe of indices. However, insufficient attention is given to the criteria of specific climate and transition-related labels and databases. Investors frequently consider these either directly or indirectly, through the equity and bond indices in which they invest. Transitioning from one category to another can have a substantial impact on factors such as the liquidity of an instrument or the size of a book in the primary market. |

| STEP 4 | Set-up and disclose a transition plan | Consider publishing a transition plan (and call it a transition plan). Regulatory obligations are in place, but, more importantly, investors frequently express frustration in not being able to locate all the elements of a company’s transition plan in one central location. |

Climate financing is a universe in constant evolution, and what was considered good yesterday is merely average today. This evolution is influenced by investor expectations, regulatory changes, data availability and the impact of climate change.

Another example of this is the upcoming requirements for the publication of transition plans. I anticipate that these will spark a wave of innovation in the bond market, where climate targets will be defined in the plan rather than relying on other voluntary mechanisms.

With higher interest rates impacting companies’ cost of capital, CFOs will need to find effective ways to access all available investment pools. Utilising various climate instruments, labelling and disclosure of transition plans can assist CFOs in lowering their cost of capital while safeguarding their business against climate risk. In the end, best in class finance teams consistently track the evolution of investor preferences, regulations, and market developments. This demands agility.

I look forward to receiving your views on this and other topics.

Get in touch: fabrizio@impactivise.com