Climate-aligned benchmarks for bonds

Looking for perfection?

Benchmarking in the world of fixed income has always been a more intricate endeavour compared to equities. I vividly remember my involvement in this domain back in 2011, a time when ETFs in Fixed Income were a relatively small universe. During that period, I joined Source, an ETF provider that just partnered with bond giant PIMCO to pioneer active, and smart beta ETFs. The rationale for the partnership was grounded in the inherent complexities of bonds (liquidity, credit risk, etc.) that made them a challenging asset class to manage passively. Fast forward to the present day, I find myself assisting asset owners and collaborating with the University of Cambridge (See here interview to Lily Tomson) on bond indexing, this time with the added climate objective.

Given the significant proportion that passive fixed-income represents of asset owners’ assets, any improvement in how those benchmarks take into account climate factors has the potential to lead to meaningful impact.

Complexity, methodologies and incomplete data

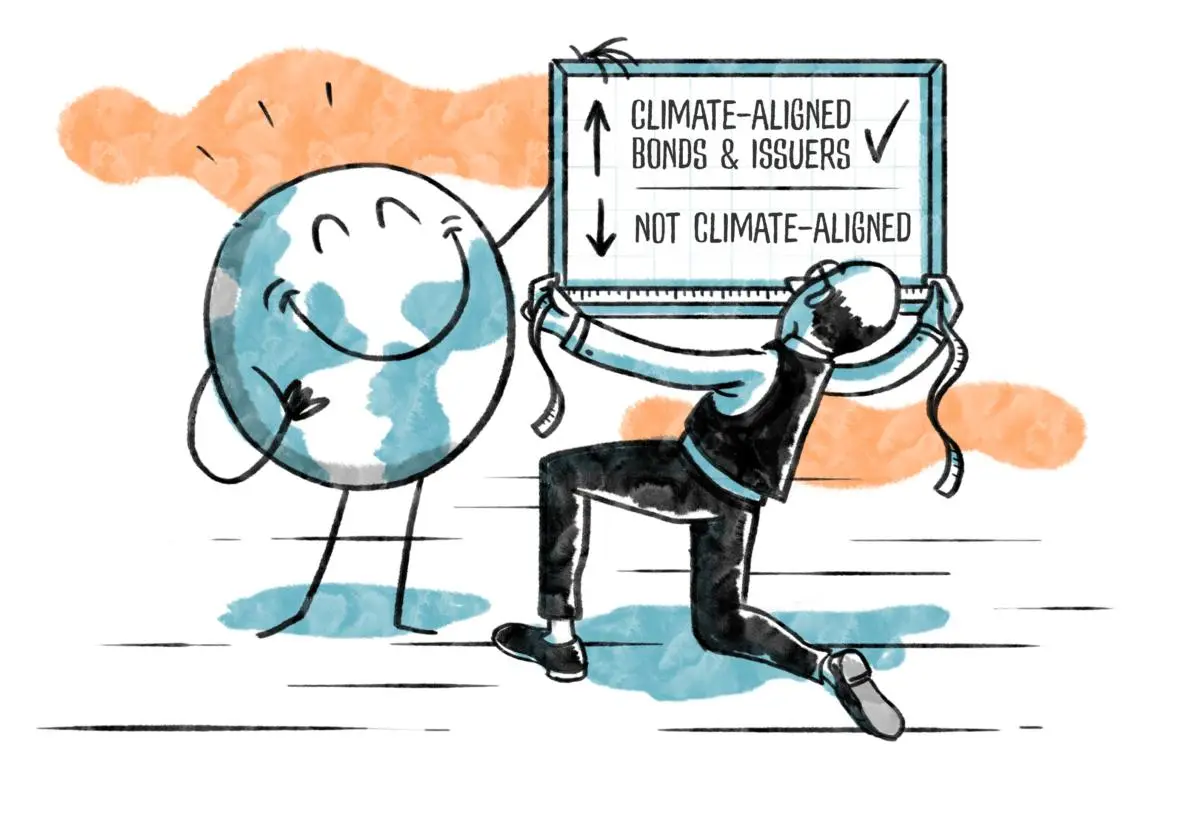

By climate-aligned benchmark I mean an index that typically entails an annual decarbonization pathway. The two predominant methodologies were developed by the EU’s Technical Expert Group (TEG): Paris-aligned (PAB) and EU Climate Transition (CTB) benchmarks. These catalysed the creation of numerous indices and methodologies for both equity and bond indices, some of which have been replicated by ETF providers. The question is whether these have a credible Paris objective.

The central question is this: How can we develop a systematic set of rules for bonds that both tackles the inherent complexity of the climate issue and harnesses the benefits of a benchmark? These benefits include:

- The prospect of cost-effective investments

- Maintaining a diversified high-quality bond exposure

- A low tracking-error

Prominent entities in this field include Bloomberg, FTSE, Solactive, Standard & Poor’s, each contributing significantly to the discourse. To facilitate your examination of this subject matter, I have provided at the end of the blog a selection of valuable publications. One thing to note from the outset: there is no such thing as a flawless benchmark, and this realisation can be somewhat disheartening.

Challenges

Incomplete data: The availability of comprehensive carbon footprint data for all bonds remains inconsistent. For example, bonds could be issued from different subsidiaries within a group. This would require the footprint data for every issuing entity. FTSE’s in-depth analysis, as elaborated in its publication, serves as a valuable resource in addressing this data discrepancy challenge.

Regional constraints: The implementation of regional benchmarks in certain markets can pose challenges without sacrificing the advantages of diversification.

Limited availability of forward-looking indicators: One of the prevailing challenges pertains to the scarcity of rigorously tested forward-looking indicators. These indicators may encompass criteria such as the availability of a company’s transition plan, fossil fuel expansion or a credible commitment to a decarbonisation objective. This is especially relevant to avoid excluding high emitters committed to decarbonisation.

Excessive stringency in criteria: Aspirations for an elusive “perfect” benchmark can introduce excessively stringent criteria (for example, the blanket exclusion of certain sectors), significantly diminishing the investable universe and potentially compromising diversification objectives.

Divergence in climate metrics: The spectrum of climate metrics encompasses both absolute and relative emissions, each carrying its unique advantages and drawbacks. Comprehending the trade-offs is important to understanding the real decarbonisation impact.

Rigidity of benchmark rules: The inherent systematic nature of benchmarks, coupled with inflexible rules, may yield outcomes that diverge from their intended purposes. For instance, this may manifest as divestment from hard-to-abate sectors or an unintended increase in exposure to instruments from the financial sector as the global economy fails to decarbonise at the pace of the 1.5C trajectory.

Opportunities

As mentioned above there is no flawless benchmark and there are numerous trade-offs to make. The nuances of these trade-offs permeate various facets of benchmark selection. I would highlight some of those:

Solvability of challenges: Most of the challenges mentioned above are not insurmountable and can be addressed, albeit at the expense of introducing more intricate rules at the limit of active management.

Thematic bond universe growth: The burgeoning thematic bond universe, encompassing green bonds and others, presents an opportunity to expand the investable universe. See here some more statistics from Climate Bonds Initiative on the expanding universe.

Evolution of methodologies and metrics: The proliferation of methodologies and metrics for assessing transition planning offers promise in developing forward-looking indicators.

Climate credentials measurement: Climate benchmarks can serve as valuable tools for evaluating the climate credentials of asset managers, facilitating constructive engagement.

Corporate engagement tools: Properly signposted, these indices can function as engagement tools, empowering investors to engage with companies at risk of exclusion due to their performance on metrics.

| Trade-off | Drawbacks |

|---|---|

| Investability | More restrictions may lead to a less investable the universe |

| Replication cost | Complexity may increase turnover and increase trading costs |

| Tracking-error | Complexity may alter sectoral make-up of the climate index versus its base index |

| Ease of understanding | Complexity may increase the difficulty in understanding the index from an impact perspective |

My recommendations

Tailored solutions: In the current landscape, opting for bespoke benchmarks emerges as a judicious choice for bond indices. While EU benchmark regulations provide a robust initial framework, investors should not be constrained by them, given their diverse requirements.

Forward-looking flexibility: Infuse flexibility into your investment approach with the use of forward-looking metrics either to avoid unduly exclusion or expand the investable universe.

Ethical anchoring:Given the trade-offs that one needs to make, it is important to uphold steadfast ethical principles and overarching values in the process of benchmark construction and investment decisions.

Synergy with experts: Forge partnerships with seasoned experts, encompassing index providers and portfolio managers, who can provide invaluable insights for adeptly navigating this intricate investment terrain.

Establish an expert panel: Establish an expert committee to tackle intricate, borderline scenarios, constructing well-informed decisions in multifaceted situations.

In my next blog installment, I will delve into the pivotal role of green bonds in climate transition. I look forward to hearing your views.

Get in touch: fabrizio@impactivise.com

Publication links

https://www.ftserussell.com/research/paris-aligned-corporate-bond-benchmark

https://www.insightinvestment.com/investing-responsibly/perspectives/climate-benchmarks/